What is the Difference Between Traditional and Fractionalized Investment?

Traditional investment in assets like real estate or stocks typically requires significant capital. Investors must buy entire assets, whether a property, a share, or a bond, often paying the full cost and risks associated with the asset. This model offers control but limits portfolio diversification, as investing in multiple high-value assets can be expensive and unmanageable.

In contrast, fractionalized investment allows for shared ownership of an asset, where multiple investors pool their resources to own a fraction. This model reduces the capital needed, opening doors to smaller investors who can diversify their portfolios across several high-value assets. Fractional ownership through tokenization enhances liquidity by allowing tokens to be traded on tokenization platforms almost instantly.

Moreover, blockchain ecosystems enable easier and faster transactions for fractionalized investments, helping reduce the barriers to investment opportunities. Traditional fractionalized investments usually suffer from limited liquidity, with shares harder to trade or sell. Tokenization, however, changes this landscape by facilitating almost immediate trading of fractional shares on blockchain platforms, making the asset more liquid and accessible.

Tokenization has transformed the financial and investment marketplace by converting Real-World Assets (RWA) into digital tokens using blockchain technology. Through asset tokenization, RWAs such as real estate, art, and commodities are increasingly accessible to a broader range of investors. This change in doing business is making the markets that have traditionally been exclusive become more democratic and improving the processes of liquidity, transparency, and efficiency. This blog will examine the complexities of tokenization, the contribution of blockchain technology, and why tokenized RWAs are likely to be the future of investment.

Introduction to Tokenization and RWA (Real World Assets)

What is RWA (Real World Assets)?

RWAs refer to physical or tangible assets in the real world, such as real estate, commodities, and intellectual property. Due to the high costs associated with acquiring, maintaining, and managing them, RWAs have traditionally been the domain of wealthy investors and institutions. However, tokenization is changing this dynamic by splitting these assets into digital tokens, making them accessible to retail investors.

According to Binance Academy, RWAs are expected to drive the next wave of blockchain innovation by making previously illiquid markets more liquid and accessible. Tokenized RWAs can include everything from residential real estate to fine art, offering investors a way to diversify their portfolios while benefiting from the security and transparency provided by blockchain.

What is Tokenization?

Tokenization is a technological process that transforms real-world assets into digital tokens. These tokens represent ownership stakes in real estate, gold, or artwork. Once tokenized, these digital representations of assets can be easily traded, bought, or sold on tokenization platforms. The entire process is secured by blockchain’s decentralized ledger, ensuring transparency and reducing the potential for fraud.

Tokenization differs from traditional fractional ownership in several significant ways:

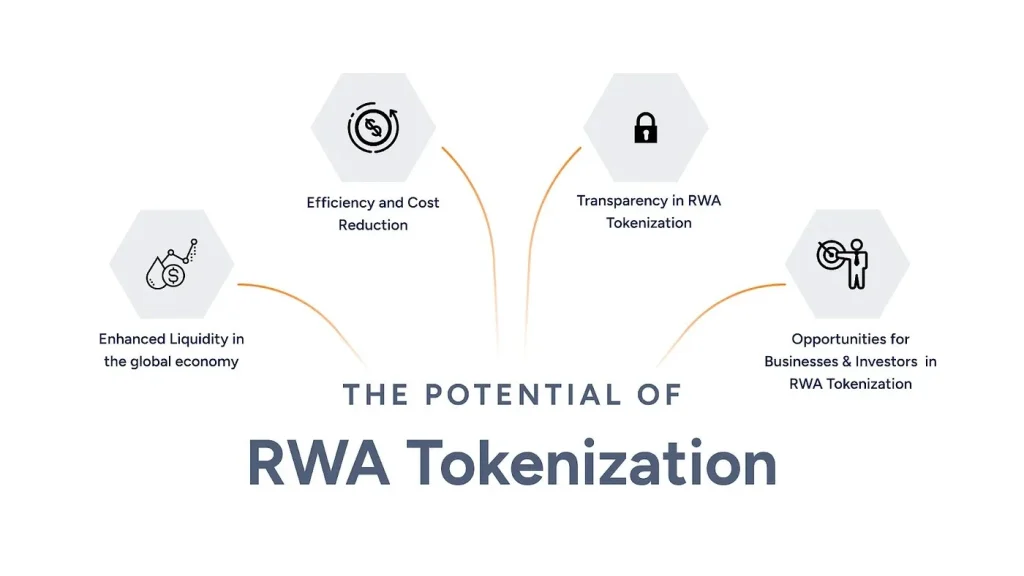

- Transparency — Tokenized assets are recorded on a blockchain, enabling increased transparency, security, and efficiency in transactions for these assets.

- Efficiency — Smart contracts eliminate the need for intermediaries by automating the process. Buyers and sellers can settle transactions instantly, thus minimizing the cost of transactions.

- Liquidity — Tokenization allows for fractional ownership, making trading smaller portions of an asset easier. This enhances liquidity, as assets typically illiquid, like real estate or art, can be bought and sold more freely.

- Accessibility — Tokenization opens up investment opportunities to a wider range of people. Investors from different geographic locations and with varying financial capacities can participate in high-value asset markets that were previously difficult to access.

Tokenization refers to converting physical or intangible assets into digital tokens. These tokens can be traded, bought, and sold on tokenization tokenization platforms, allowing for fractional ownership and more efficient transactions. RWAs such as real estate, precious metals, and intellectual property are being tokenized to offer more investment opportunities.

Blockchain’s decentralized and secure nature underpins this transformation, making it a groundbreaking tool for modern fintech and property investment.

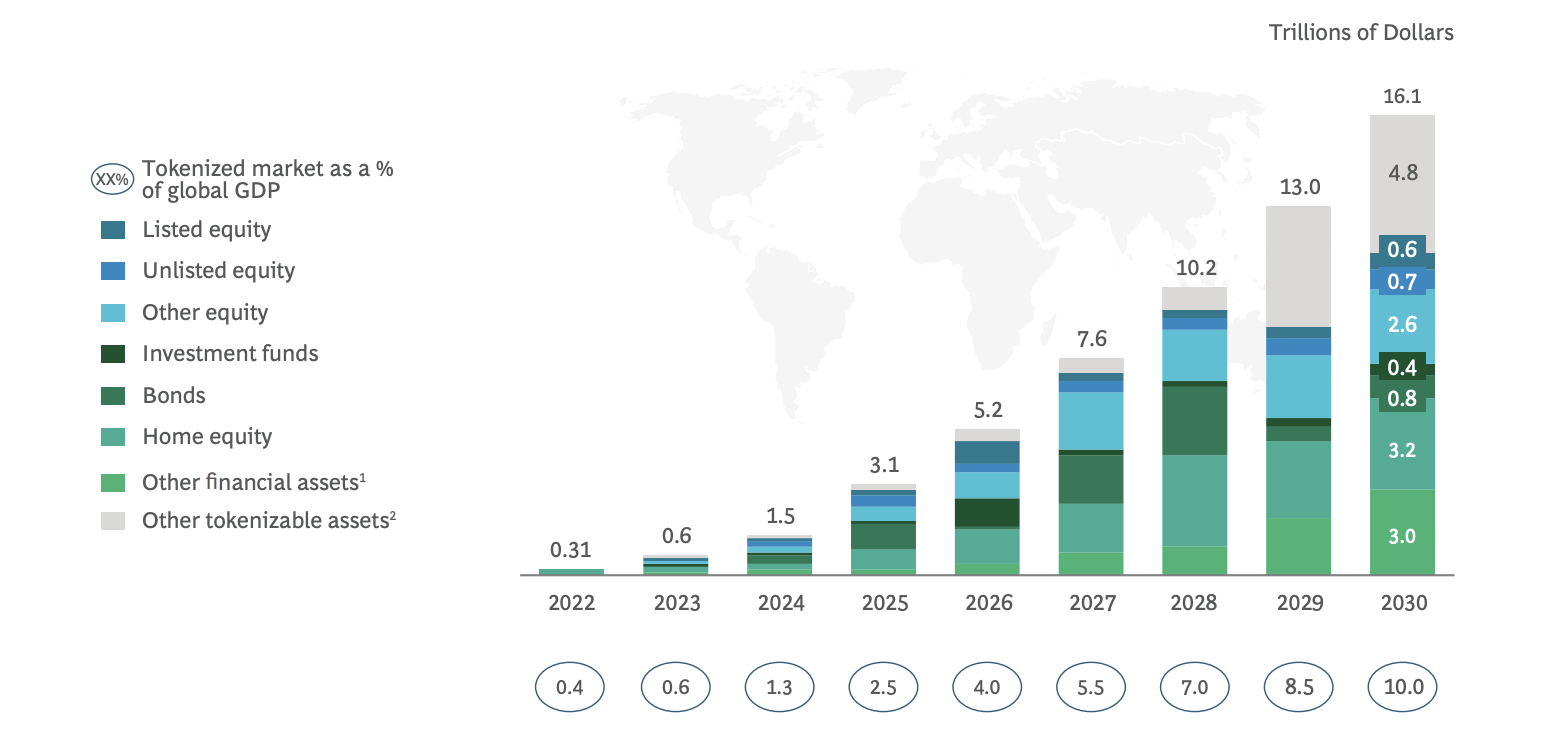

According to BCG, the potential market for tokenized assets is huge, with projections indicating that this market could reach over $16.1 trillion by 2030. The growing popularity of decentralized finance (DeFi) platforms further accelerates this trend, as tokenized assets provide new ways for investors to engage with traditionally inaccessible high-value assets.

Blockchain’s Role in Tokenization

The blockchain serves as the foundation of the entire tokenization process. This decentralized ledger technology allows for the unique and secure identification of assets and their transactions. Blockchain can continuously update all ownership and transaction data in real-time, allowing for the transfer of ownership when assets are bought and sold.

The use of smart contracts further enhances the efficiency of tokenized transactions. Such contracts are self-operating agreements in which all parties agree on the contract’s terms to be stored within the system’s code. They automate processes such as transferring ownership, distributing dividends, or executing trades, significantly reducing transaction times and costs.

Moreover, blockchain eliminates negotiators, cutting fees and simplifying the transaction process. The fractionalization of real-world assets on tokenization platforms creates liquidity, enabling even retail investors to participate in markets like real estate with lower barriers to entry.

How Does Tokenization Work?

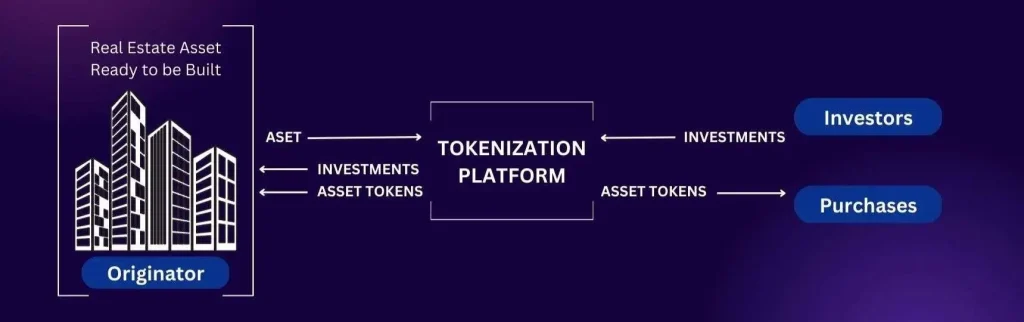

The tokenization process begins by identifying a high-value asset. Each token represents a share of the asset, and investors can purchase, sell, or trade these tokens.

Tokenization platforms facilitate these transactions by maintaining a decentralized ledger that records each token’s ownership and transaction history. Smart contracts ensure that ownership transfers happen automatically once payment conditions are met.

For example, a real estate developer could tokenize a property by creating 100,000 tokens, each representing a share of the building. Investors can then buy and trade these tokens without purchasing the entire property. This process opens up real estate markets to retail investors who may only be able to afford a small share rather than the whole building. Some platforms have made tokenized real estate a reality, allowing investors to maximize rental income and capital appreciation.

How is the RWA (Real World Assets) Market Evolving?

The RWA market is evolving rapidly, with tokenization driving much of this change. By breaking down large, expensive assets into tradeable digital tokens, tokenization allows more investors to participate in previously inaccessible markets. This process is particularly transformative in real estate, where properties can now be bought and sold as fractional tokens on blockchain platforms.

Adopting RWAs in decentralized finance (DeFi) protocols further expands the market. Integrating RWAs into DeFi ecosystems enhances liquidity and diversifies available assets for collateral and lending. This trend is already evident in some platforms, where RWAs are used as a guarantee to secure stablecoins.

Additionally, tokenizing RWAs introduces new investment opportunities in emerging markets. Retail investors can now access asset classes like real estate, which were once reserved for institutional investors.

What are the Numbers?

The current size and potential growth of the tokenized RWA market are staggering. As noted by Finance Yahoo, the global real estate market alone is valued at over $350 trillion, and even a small portion of that being tokenized could represent trillions in tradable assets.

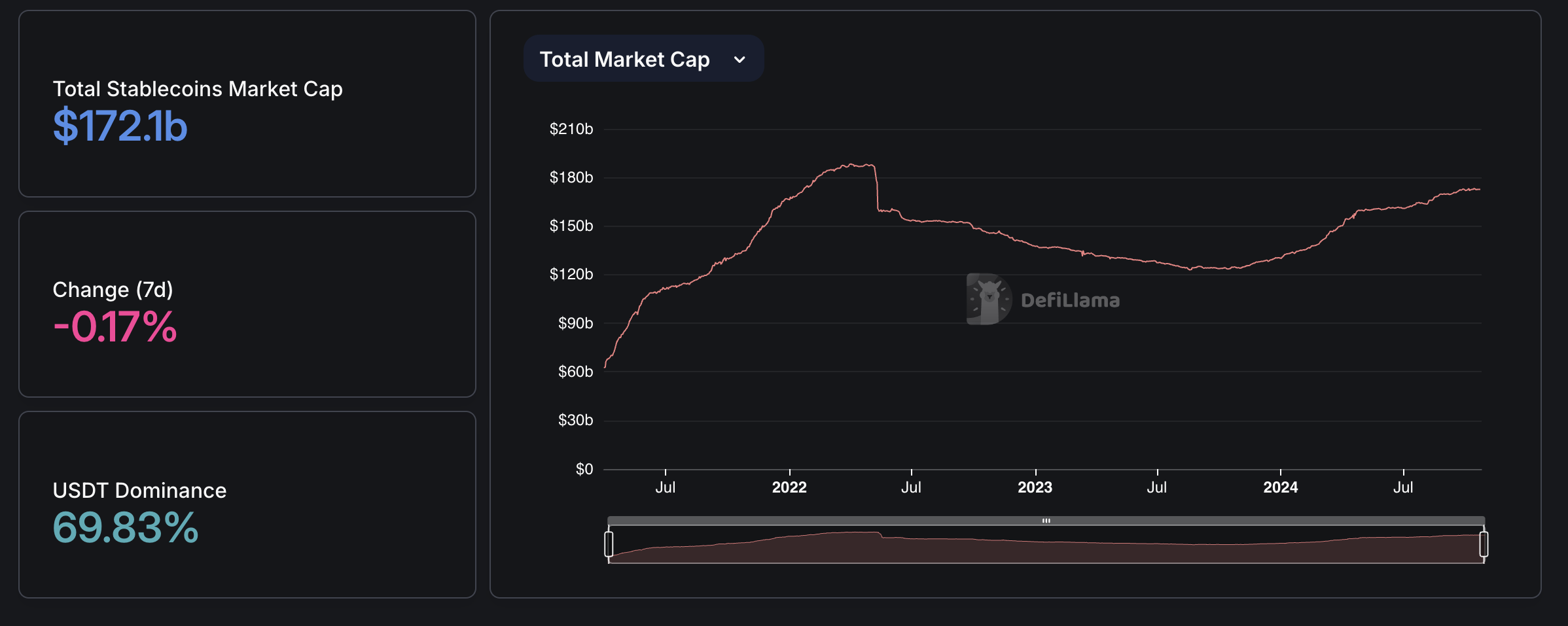

This significant shift is also happening across various sectors, including commodities, art, and debt markets. Hacken says platforms like Centrifuge and Ondo Finance have already tokenized assets such as U.S. treasuries and corporate bonds. According to DefiLlama, the total stablecoins market cap have exceeded $170 billion, highlighting the growing integration of stablecoins into both traditional and decentralized financial systems.

What are the Expectations for the Growing Market?

The tokenization of RWAs is still in its early stages, but the market potential is huge. As blockchain adoption expands, more sectors are exploring the benefits of tokenizing their assets. The ability to fractionalize high-value assets such as real estate allows more retail investors to participate, diversifying the investor base.

The DeFi ecosystem is already making strides in adopting RWAs as a guarantee, especially in the lending and borrowing markets. This trend will likely continue, providing new avenues for institutional and retail investors to engage with decentralized financial products. RWAs are also expected to improve the stability of the crypto ecosystem by introducing low-risk collateral into DeFi markets.

In addition to institutional adoption, emerging markets are set to benefit from the tokenization of RWAs. Investors in these regions, who may have limited access to traditional financial systems, will be able to invest more easily in global assets.

Why Invest in Tokenized RWA?

Several compelling reasons exist to invest in tokenized RWAs, making them an attractive addition to any investment portfolio.

1. Increased Liquidity — Increased liquidity is one of the most significant benefits of tokenized RWAs. Traditional assets like real estate are often illiquid, requiring significant time and resources to buy or sell. However, once tokenized, these assets can be traded on tokenization platforms almost instantaneously, providing greater flexibility for investors.

2. Lower Entry Barriers — Tokenization breaks down high-value assets into smaller, more affordable digital tokens, allowing retail investors to participate in previously inaccessible markets.

3. Diversification — Tokenized RWAs allow investors to spread risk across different asset classes. Instead of purchasing one entire property, for example, investors can buy fractions of multiple properties, commodities, or artworks, which enhances their portfolio diversification. By diversifying their investments, investors can reduce their asset or market risk exposure.

4. Enhanced Transparency — Blockchain technology offers a high level of transparency. Every transaction related to tokenized assets is recorded on the blockchain, immutable, and visible to all participants. This transparency reduces the risk of fraud and ensures that investors clearly understand the assets they own.

5. Faster and More Efficient Transactions – Smart contracts automate the process of buying, selling, and transferring ownership of tokenized assets. This reduces the time it takes to settle transactions and eliminates the need for intermediaries, lowering costs for buyers and sellers.

Conclusion

The tokenization of RWAs is revolutionizing the investment landscape by making previously inaccessible assets available to a broader range of investors. Blockchain adoption provides the transparency, security, and liquidity needed to manage tokenized securities effectively. While challenges remain, particularly around crypto regulations and market volatility, the future of RWAs looks promising.

For investors, tokenized RWAs offer a unique opportunity to diversify portfolios, reduce entry barriers, and participate in real estate investment trust (REIT) markets and other asset classes. As the market for tokenized RWAs continues to grow, it is clear that financial innovation through blockchain is here to stay.